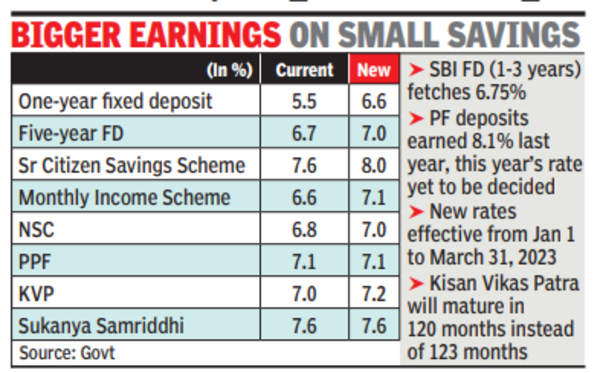

The popular Public Provident Fund (PPF) return was maintained steady at 7.1% for the eleventh consecutive quarter by the Central government, but interest rates on eight of the 12 minor savings plans were hiked by 20 to 110 basis points on Friday. 0.01% is equal to one basis point, or bps.

The Sukanya Samriddhi Account Scheme's return was also held steady at 7.6% from April 2020, when rates for all modest savings plans were reduced. Just 20 bps each, or 7.2% and 7%, were added to the yields on the Kisan Vikas Patra (KVP) and National Savings Certificate (NSC), respectively.

The government has selectively increased small savings rates for the second consecutive quarter. Given the rise in interest rates and the rising inflation in recent quarters, economists claimed that the rises were smaller than anticipated.

For the first time since January 2019, rates were hiked for the current October to December quarter for just five of the 12 schemes. According to calculations by the Reserve Bank of India, for nine of the 12 schemes, the small savings rates—which are based on a formula tied to the yields on government securities—were 44 to 77 bps lower this quarter than their formula-implied rates.

According to the methodology, the PPF return for October through December should have been 7.72% instead of the current 7.1%, and the payment to the Sukanya Samriddhi Account should have been 8.22% instead of 7.6%.

The returns on the Monthly Income Account Scheme and the Senior Citizens' Savings Scheme have been increased by 40 bps, bringing them to 8% and 7.1%, respectively.

ICRA Chief Economist Aditi Nayar told The Hindu that "the extent of the upward revision in rates of some modest savings programmes is smaller than what we had anticipated."

The returns for the Senior Citizens' Savings Scheme were increased for this quarter from 7.4% to 7.6%, whereas the rate set by the formula was 8.04%. As a result, its rate increase to 8% for the upcoming quarter nearly eliminates the entire divergence from the rate determined by a formula.

The difference between the formula-based rate of 7.5% for the quarter of October to December and the new rates for the following quarter, however, was greater in the cases of the NSC (7.1%) and KVP (7.2%).

The most significant 110 bps rise in returns was given to term deposits for one, two, and three years, which increased their returns to 6.6%, 6.8%, and 6.9%, respectively.

While five year recurring deposits will continue to receive a 5.8% return, which is the same as before, five year time deposits will earn 7% in the first quarter of 2023 as opposed to 6.7% in the current quarter.

🕑 28 Oct, 2025 04:46 PM

🕑 28 Oct, 2025 04:46 PM

8th Pay Commission constituted. ToR Approved, Effectively Jan 2026

🕑 02 Jul, 2025 10:03 AM

🕑 02 Jul, 2025 10:03 AM

Commutation Relief In Sight? Panel Likely To Review 15-Year Deduction Rule

🕑 12 Jun, 2025 08:12 AM

🕑 12 Jun, 2025 08:12 AM

8th Pay Commission: Uncertainty Looms as Employees Await Terms of Reference

🕑 24 Apr, 2025 10:21 PM

🕑 24 Apr, 2025 10:21 PM

Staff Side constitutes panel for drafting memorandum to 8th CPC when formed

🕑 24 Apr, 2025 10:17 PM

🕑 24 Apr, 2025 10:17 PM

8th Pay Commission likely to be set up by mid May

🕑 09 Apr, 2025 10:27 AM

🕑 09 Apr, 2025 10:27 AM

Loan EMIs to get Cheaper as RBI cuts Repo Rate sgain | See the benefit

🕑 09 Jun, 2025 08:25 AM

🕑 09 Jun, 2025 08:25 AM

📢 UPS vs NPS: The Retirement Dilemma Facing 27 Lakh Government Employees

🕑 04 Apr, 2025 04:46 PM

🕑 04 Apr, 2025 04:46 PM

NPS To UPS Switch from April 1: A Detailed Look at the Option to Switch

🕑 30 Mar, 2025 11:01 AM

🕑 30 Mar, 2025 11:01 AM

8th Pay Commission implementation may get delayed till 2027 – Here’s why

🕑 27 Mar, 2025 10:25 PM

🕑 27 Mar, 2025 10:25 PM

7th CPC wanted a permanent pay panel, end DA revision twice

🕑 27 Mar, 2025 08:43 AM

🕑 27 Mar, 2025 08:43 AM

8th Pay Commission: What Kind Of Salary Hike Can Be Staff Expected?

🕑 20 Mar, 2025 08:24 AM

🕑 20 Mar, 2025 08:24 AM

Why the commuted pension is restored after 15 years, not 12 years

🕑 17 Mar, 2025 08:37 AM

🕑 17 Mar, 2025 08:37 AM

📈 Expected Dearness Allowance (DA) from January 2026 Calculator