The government has announced a committee under the finance secretary to address the concerns of the employees over the pension as per the NPS. The formation of the new committee comes in the backdrop of several non-BJP states deciding to revert to the dearness allowance-linked old pension scheme. Some employee organisations in other states are also raising demand for the same.

States like Rajasthan, Chhattisgarh, Jharkhand, Punjab and Himachal Pradesh have already the Central government about their decision to revert to the old pension scheme. Moreover, they have also requested a refund of the corpus accumulated under the NPS.

Intending to make the new pension scheme (NPS) more lucrative, the government has formed a committee. The new committee under the finance secretary will try to address the concerns of employees and make changes in the NPS accordingly. This will be done while making sure that fiscal prudence is maintained.

Union Finance Minister Nirmala Sitharaman, while moving the Finance Bill 2023 for consideration and passage in the Lok Sabha, said the new approach to the new pension scheme will be designed for adoption by both central and state governments.

The central government has already informed the Parliament that it is not considering any proposal to restore the OPS in respect of the central government employees recruited after January 1, 2004.

Speaking on the announcement, Information and Broadcasting Minister Anurag Thakur said the committee will look at various suggestions on the NPS-OPS issue.

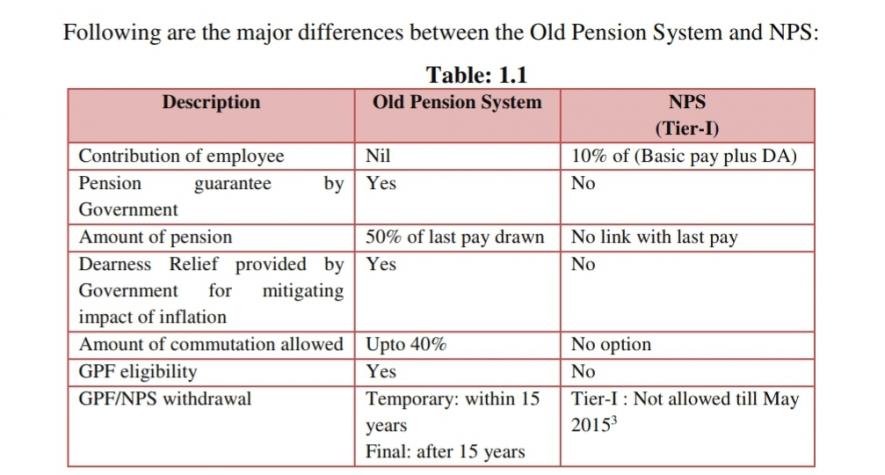

Under the OPS, retired government employees received 50 per cent of their last drawn salary as monthly pensions. The amount keeps increasing with the hike in the DA rates. NPS is based on a contributory system in place of the older system in a bid to lessen its economic burden. In NPS, 10% of the basic salary and DA is compulsorily deducted from an employee’s salary and the same amount is added by the government for the pension fund. There was the provision that at the time of retirement, an employee will be given back 60% of this fund and the remaining 40% would have to be compulsorily invested as an annuity for pension.

Unfortunately, NPS replaces the 1972 Central Civil Services (Pension) Act, which had provisions for inbuilt family pension and gratuity.

Still, there is no provision for a minimum guarantee of pension in case of fewer than 20 years of service before retirement. There are so many cases of retirees who are getting pensions below Rs 5,000/month because of the corpus-based pension system.

The NPS is based on long-term investment fund ideology and it could be better in the case of more than 30 years of service. But, in case of fewer years of service, due to lower corpus, the pension is not sufficient for the retiree’s survival.

The Centre is now reportedly considering or forced to consider the option to offer a "guaranteed pension" to government employees under the National Pension System (NPS). Even though this may not be equivalent to around 50 per cent of the last pay drawn as in the case of an old pension, it will assure a pension for making a decent retired life. A scheme proposed by Andhra for the first time in April 2022 offers a guaranteed pension of 33% of the last drawn basic pay without any deduction to the state government employees can be considered as a model towards this.

🕑 28 Oct, 2025 04:46 PM

🕑 28 Oct, 2025 04:46 PM

8th Pay Commission constituted. ToR Approved, Effectively Jan 2026

🕑 02 Jul, 2025 10:03 AM

🕑 02 Jul, 2025 10:03 AM

Commutation Relief In Sight? Panel Likely To Review 15-Year Deduction Rule

🕑 12 Jun, 2025 08:12 AM

🕑 12 Jun, 2025 08:12 AM

8th Pay Commission: Uncertainty Looms as Employees Await Terms of Reference

🕑 24 Apr, 2025 10:21 PM

🕑 24 Apr, 2025 10:21 PM

Staff Side constitutes panel for drafting memorandum to 8th CPC when formed

🕑 24 Apr, 2025 10:17 PM

🕑 24 Apr, 2025 10:17 PM

8th Pay Commission likely to be set up by mid May

🕑 09 Apr, 2025 10:27 AM

🕑 09 Apr, 2025 10:27 AM

Loan EMIs to get Cheaper as RBI cuts Repo Rate sgain | See the benefit

🕑 09 Jun, 2025 08:25 AM

🕑 09 Jun, 2025 08:25 AM

📢 UPS vs NPS: The Retirement Dilemma Facing 27 Lakh Government Employees

🕑 04 Apr, 2025 04:46 PM

🕑 04 Apr, 2025 04:46 PM

NPS To UPS Switch from April 1: A Detailed Look at the Option to Switch

🕑 30 Mar, 2025 11:01 AM

🕑 30 Mar, 2025 11:01 AM

8th Pay Commission implementation may get delayed till 2027 – Here’s why

🕑 27 Mar, 2025 10:25 PM

🕑 27 Mar, 2025 10:25 PM

7th CPC wanted a permanent pay panel, end DA revision twice

🕑 27 Mar, 2025 08:43 AM

🕑 27 Mar, 2025 08:43 AM

8th Pay Commission: What Kind Of Salary Hike Can Be Staff Expected?

🕑 20 Mar, 2025 08:24 AM

🕑 20 Mar, 2025 08:24 AM

Why the commuted pension is restored after 15 years, not 12 years

🕑 17 Mar, 2025 08:37 AM

🕑 17 Mar, 2025 08:37 AM

📈 Expected Dearness Allowance (DA) from January 2026 Calculator