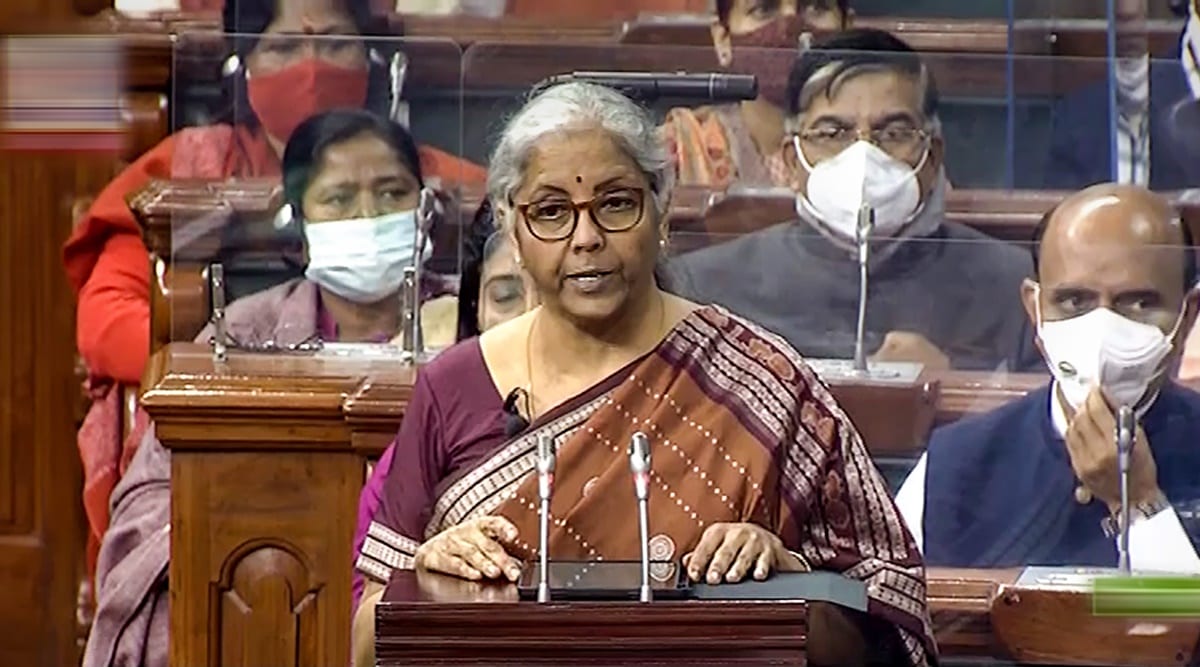

In a big disappointment for salaried individuals, FM Sitharaman did not announce any change in income tax slabs for 2022-23. The income tax rates for 2022-23 were also not revised.

The finance minister has concluded the budget speech without any mention of any change in personal tax rates/slabs or an increase in any exemption/deduction limits.

The expectations were high with rumours of changes in income tax slabs for 2022-23 and possible standard deduction revision to account for more work for home expenses, higher limits for investments under Chapter VI-A (Section 80C, Section 80D).

The only benefit for the government employees that too only state government employees are the deduction of the contribution to the NPS account Employees of the state governments will be able to claim a tax benefit of 14% on the NPS contribution made by their employer, i.e., state government from FY 2022-23 onwards. Currently, only central government employees are eligible to claim a tax benefit of 14% for the employer’s contribution to the NPS account of an employee. In the case of private-sector employees, the tax benefit is limited to 10%.

🕑 28 Oct, 2025 04:46 PM

🕑 28 Oct, 2025 04:46 PM

8th Pay Commission constituted. ToR Approved, Effectively Jan 2026

🕑 02 Jul, 2025 10:03 AM

🕑 02 Jul, 2025 10:03 AM

Commutation Relief In Sight? Panel Likely To Review 15-Year Deduction Rule

🕑 12 Jun, 2025 08:12 AM

🕑 12 Jun, 2025 08:12 AM

8th Pay Commission: Uncertainty Looms as Employees Await Terms of Reference

🕑 24 Apr, 2025 10:21 PM

🕑 24 Apr, 2025 10:21 PM

Staff Side constitutes panel for drafting memorandum to 8th CPC when formed

🕑 24 Apr, 2025 10:17 PM

🕑 24 Apr, 2025 10:17 PM

8th Pay Commission likely to be set up by mid May

🕑 09 Apr, 2025 10:27 AM

🕑 09 Apr, 2025 10:27 AM

Loan EMIs to get Cheaper as RBI cuts Repo Rate sgain | See the benefit

🕑 09 Jun, 2025 08:25 AM

🕑 09 Jun, 2025 08:25 AM

📢 UPS vs NPS: The Retirement Dilemma Facing 27 Lakh Government Employees

🕑 04 Apr, 2025 04:46 PM

🕑 04 Apr, 2025 04:46 PM

NPS To UPS Switch from April 1: A Detailed Look at the Option to Switch

🕑 30 Mar, 2025 11:01 AM

🕑 30 Mar, 2025 11:01 AM

8th Pay Commission implementation may get delayed till 2027 – Here’s why

🕑 27 Mar, 2025 10:25 PM

🕑 27 Mar, 2025 10:25 PM

7th CPC wanted a permanent pay panel, end DA revision twice

🕑 27 Mar, 2025 08:43 AM

🕑 27 Mar, 2025 08:43 AM

8th Pay Commission: What Kind Of Salary Hike Can Be Staff Expected?

🕑 20 Mar, 2025 08:24 AM

🕑 20 Mar, 2025 08:24 AM

Why the commuted pension is restored after 15 years, not 12 years

🕑 17 Mar, 2025 08:37 AM

🕑 17 Mar, 2025 08:37 AM

📈 Expected Dearness Allowance (DA) from January 2026 Calculator