Despite the ongoing controversy over the drastic change in recruitment practises under the Agnipath initiative, the government is getting ready to roll out arrears for defence pensioners under the One Rank One Pension (OROP) policy, according to sources with knowledge of the situation.

Defence pensioners are anticipated to earn arrears in excess of Rs 2,000 crore as the government would modify all scales with effect from 2019, with payout likely to take place in the coming weeks. The modification had been held up for the past three years as a group of ex-servicemen had dragged the government to the Supreme Court, demanding revisions in the OROP policy.

In a judgement in March, the Supreme Court rejected the appeal for revisions and backed the government's stance that all pension scales should be altered once in five years, against the demand of petitioners for an annual rise.

According to the sources, tangible progress has been achieved, and final permissions for a payout are being completed to roll out the arrears as soon as possible. They also stated that a formal announcement is anticipated soon.

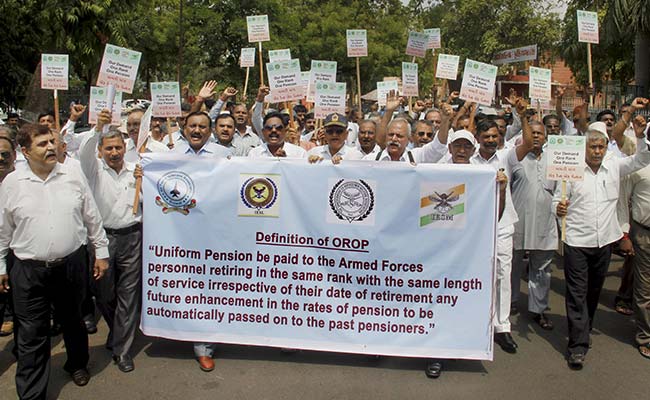

In general, the OROP policy aims to provide retired troops with uniform pensions regardless of when they left the military. Earlier, recently retired troops enjoyed much greater pensions than those who retired at the same level in the past. The OROP programme, which was implemented in September 2015 and increased the military services' pension costs by Rs 10,392.35 crore, was a key component of the BJP's election platform for 2014. According to official records, the budget allocation for defence pensions for 2020-21 was Rs 1,33,825 crore, which equated to 28.39 per cent of the overall defence expenditure. Nearly 63% of the estimated defence expenditure for the fiscal year was made up of salaries and pensions.

🕑 28 Oct, 2025 04:46 PM

🕑 28 Oct, 2025 04:46 PM

8th Pay Commission constituted. ToR Approved, Effectively Jan 2026

🕑 02 Jul, 2025 10:03 AM

🕑 02 Jul, 2025 10:03 AM

Commutation Relief In Sight? Panel Likely To Review 15-Year Deduction Rule

🕑 12 Jun, 2025 08:12 AM

🕑 12 Jun, 2025 08:12 AM

8th Pay Commission: Uncertainty Looms as Employees Await Terms of Reference

🕑 24 Apr, 2025 10:21 PM

🕑 24 Apr, 2025 10:21 PM

Staff Side constitutes panel for drafting memorandum to 8th CPC when formed

🕑 24 Apr, 2025 10:17 PM

🕑 24 Apr, 2025 10:17 PM

8th Pay Commission likely to be set up by mid May

🕑 09 Apr, 2025 10:27 AM

🕑 09 Apr, 2025 10:27 AM

Loan EMIs to get Cheaper as RBI cuts Repo Rate sgain | See the benefit

🕑 09 Jun, 2025 08:25 AM

🕑 09 Jun, 2025 08:25 AM

📢 UPS vs NPS: The Retirement Dilemma Facing 27 Lakh Government Employees

🕑 04 Apr, 2025 04:46 PM

🕑 04 Apr, 2025 04:46 PM

NPS To UPS Switch from April 1: A Detailed Look at the Option to Switch

🕑 30 Mar, 2025 11:01 AM

🕑 30 Mar, 2025 11:01 AM

8th Pay Commission implementation may get delayed till 2027 – Here’s why

🕑 27 Mar, 2025 10:25 PM

🕑 27 Mar, 2025 10:25 PM

7th CPC wanted a permanent pay panel, end DA revision twice

🕑 27 Mar, 2025 08:43 AM

🕑 27 Mar, 2025 08:43 AM

8th Pay Commission: What Kind Of Salary Hike Can Be Staff Expected?

🕑 20 Mar, 2025 08:24 AM

🕑 20 Mar, 2025 08:24 AM

Why the commuted pension is restored after 15 years, not 12 years

🕑 17 Mar, 2025 08:37 AM

🕑 17 Mar, 2025 08:37 AM

📈 Expected Dearness Allowance (DA) from January 2026 Calculator