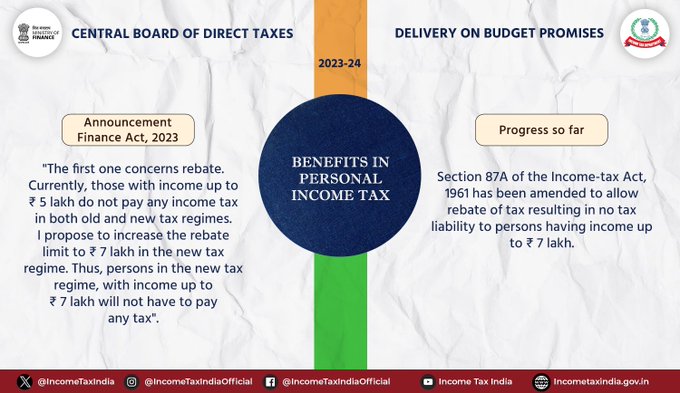

In a move aimed at providing substantial relief to middle-income earners, the Ministry of Finance in India has announced a key amendment to the personal income tax regime, surpassing a promise outlined in the Finance Act, 2023. The revision raises the income threshold for tax rebates under Section 87A of the Income-tax Act, 1961, from Rs 5 lakh to Rs 7 lakh.

A tax rebate, as explained by experts, is a refund or reduction in the amount of tax owed to the government. Unlike tax deductions that lower taxable income, a rebate directly decreases the tax liability, often resulting in a refund to the taxpayer. Such initiatives are generally employed to stimulate economic activity, encourage investments, or offer relief to specific groups of taxpayers.

Benefits in Personal Income Tax!

— Ministry of Finance (@FinMinIndia) January 15, 2024

Vide Finance Act, 2023, Section 87A of the Income-tax Act, 1961 has been amended to allow rebate to tax resulting in no tax liability to persons having income up to Rs. 7 lakh. (1/5) #PromisesDelivered pic.twitter.com/RvoKHnYynh

The Central Board of Direct Taxes (CBDT) spearheaded the implementation of this policy change, a crucial step in the government's ongoing efforts to ease the tax burden on the middle-income population. Under the new tax regime, individuals earning up to Rs 7 lakh are now exempt from paying income tax, marking a significant shift that is anticipated to benefit a wider range of taxpayers.

This move aligns with the broader economic goals of the government and is expected to boost disposable income, subsequently stimulating economic growth. The increased rebate limit is seen as a strategic step towards providing tax relief for a larger section of the population, with potential positive impacts on individual finances.

The announcement has been well-received, reflecting the government's commitment to economic reform. By proactively increasing the tax rebate limit, the government aims to support the middle-income group, which constitutes a substantial portion of the country's economic backbone. This policy adjustment is expected to contribute positively to individual financial well-being, further aligning with the government's vision for a robust and inclusive economic future.

🕑 28 Oct, 2025 04:46 PM

🕑 28 Oct, 2025 04:46 PM

8th Pay Commission constituted. ToR Approved, Effectively Jan 2026

🕑 02 Jul, 2025 10:03 AM

🕑 02 Jul, 2025 10:03 AM

Commutation Relief In Sight? Panel Likely To Review 15-Year Deduction Rule

🕑 12 Jun, 2025 08:12 AM

🕑 12 Jun, 2025 08:12 AM

8th Pay Commission: Uncertainty Looms as Employees Await Terms of Reference

🕑 24 Apr, 2025 10:21 PM

🕑 24 Apr, 2025 10:21 PM

Staff Side constitutes panel for drafting memorandum to 8th CPC when formed

🕑 24 Apr, 2025 10:17 PM

🕑 24 Apr, 2025 10:17 PM

8th Pay Commission likely to be set up by mid May

🕑 09 Apr, 2025 10:27 AM

🕑 09 Apr, 2025 10:27 AM

Loan EMIs to get Cheaper as RBI cuts Repo Rate sgain | See the benefit

🕑 09 Jun, 2025 08:25 AM

🕑 09 Jun, 2025 08:25 AM

📢 UPS vs NPS: The Retirement Dilemma Facing 27 Lakh Government Employees

🕑 04 Apr, 2025 04:46 PM

🕑 04 Apr, 2025 04:46 PM

NPS To UPS Switch from April 1: A Detailed Look at the Option to Switch

🕑 30 Mar, 2025 11:01 AM

🕑 30 Mar, 2025 11:01 AM

8th Pay Commission implementation may get delayed till 2027 – Here’s why

🕑 27 Mar, 2025 10:25 PM

🕑 27 Mar, 2025 10:25 PM

7th CPC wanted a permanent pay panel, end DA revision twice

🕑 27 Mar, 2025 08:43 AM

🕑 27 Mar, 2025 08:43 AM

8th Pay Commission: What Kind Of Salary Hike Can Be Staff Expected?

🕑 20 Mar, 2025 08:24 AM

🕑 20 Mar, 2025 08:24 AM

Why the commuted pension is restored after 15 years, not 12 years

🕑 17 Mar, 2025 08:37 AM

🕑 17 Mar, 2025 08:37 AM

📈 Expected Dearness Allowance (DA) from January 2026 Calculator